General Purchase FAQs for the FSWI Specialty License Plate

I just heard about the FSWI plate, how do I get it?

It takes a minute. Click

"Option 1: Purchased Online" on the FSWI website homepage and follow the seven step instructions to place your order. Fill out your information and submit the specialty license plate order. Your plate will be mailed to you within 7-10 business days. You can also purchase in person at your local tax collector office and leave with it the same day.

Can I keep my existing license plate number?

No. According to the official rules of the Florida Department of Highway Safety and Motor Vehicles (FLHSMV), all newly issued license plates including the FSWI specialty license plate are produced with different numbers.

How do I order a personalized plate? I want it customized!

Personalized plates are only available for purchase by ordering in person at any tax collector office. See instructions on our homepage under

"Option 2: In Person" for instructions to order. All you have to do is fill out some paperwork and bring it to your local tax collector office.

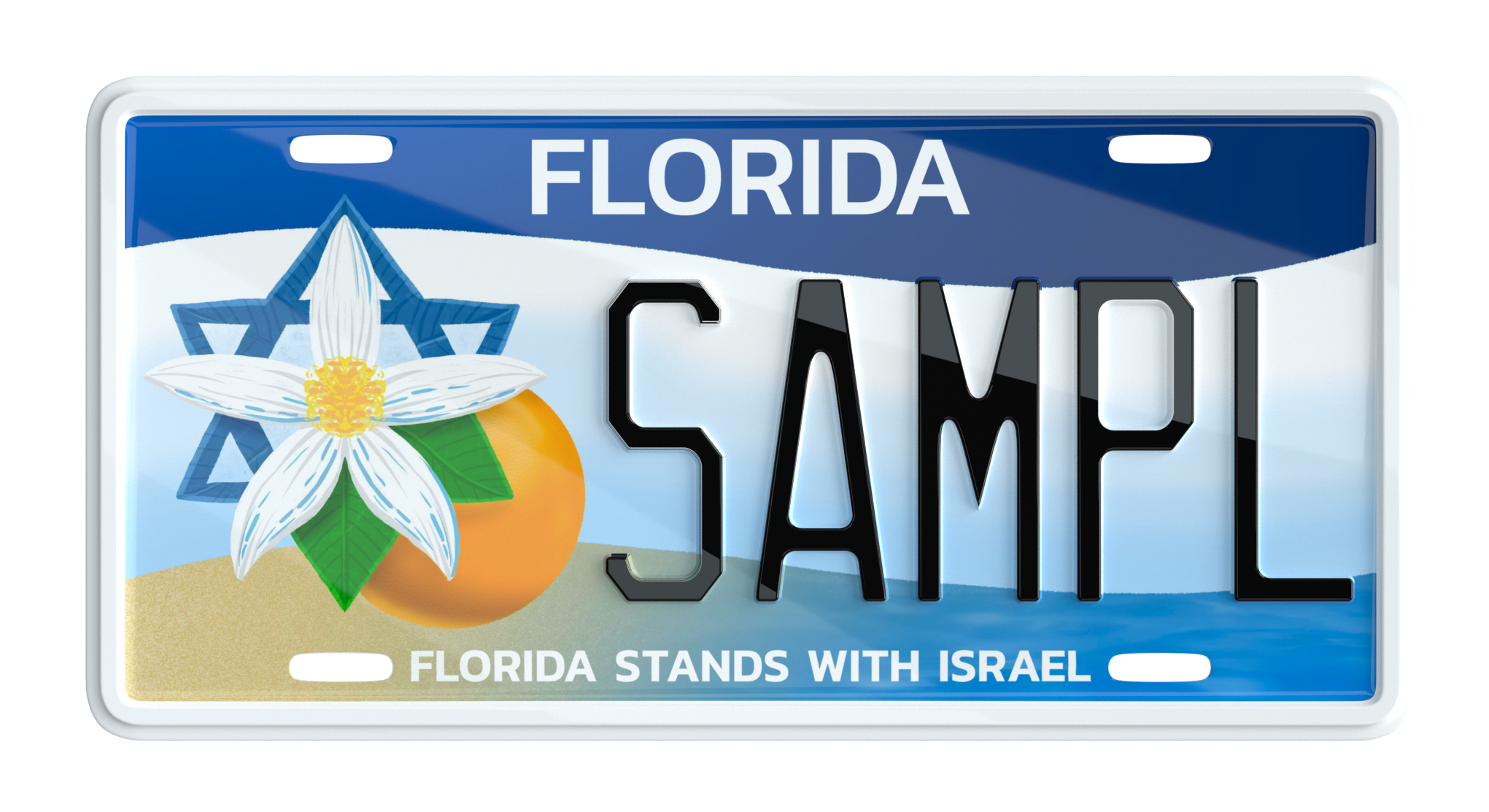

Note: FSWI is a "side design" plate and limited to five characters.

Fees and Costs

How much does the Florida Stands with Israel Specialty License Plate cost?

Specialty License Plate costs are dependent upon your particular annual registration renewal status. Taxes and fees apply.

Tax Collector Offices

Which Tax Collector offices may I order my FSWI plates from?

Customers may order their FSWI specialty license plates from any one of the 67 county tax collector offices in Florida.

Are the order links on the FSWI homepage only for Escambia and/or Pasco County residents only?

No. Any Florida motorist can use the sites. FSWI uses the Escambia and Pasco County websites due to their user-friendly ordering platforms.

What Do I Need to Know After Ordering My FSWI Plate?

How does the FSWI plate stay on the road long term? Once there are 3,000 registered plated on the road, does it stay there forever?

No, license plate sales need to be maintained. Like a plant, you can't just water it once.

• The plate must maintain over 3,000 registered plates on the road per year to avoid discontinuation and stay available for purchase.

• If the plate falls below 3,000 registered plates on the road, it enters a one-year probation period and may be discontinued. If renewals exceed 3,000 during probation, the plate remains in circulation.

• January 1st law: Every January 1st the FLHSMV Department will discontinue the license plate with the lowest number of valid registration (this could happen if the valid registrations are above 3,000).

I ordered a plate. Can I keep it as a souvenir and not put it on my car?

No. Once purchased, the license plate must be assigned to a vehicle. You must replace your current plate with the new one.

FAQs Only Relevant to Customers Who Preordered the Plate in 2024 or Earlier

I thought I paid for my plate years ago! I didn't get the plate, why not?

Because you didn't pay for a license plate. If you purchased the $30 "pre-sale voucher" in 2024 or earlier, you were a part of the preorder campaign that helped secure 3,000 preorders (referred to as "pre-sale vouchers" by the government). This tells the government there are enough folks interested to successfully put the specialty plate into production and get it printed and delivered across the state.

Like most people, you may have trouble redeeming the voucher for a license plate. Coordinating with the Tax Collectors/DMV is about as easy as getting peace in the Middle East, but we've worked to streamline the process.

Click

"Option 1: Purchased Online" on the FSWI website homepage and follow the instructions in the second NOTE. Your preordered voucher is being held electronically in the FLHSMV database under your name and driver license number. If you purchased the voucher for someone else, it is being held under the recipient's name and driver license number.

The price displayed will not account for your voucher purchase. An agent will apply your voucher when they issue the plate, and your payment will process for $30 less than the price shown.

License plate fees may differ based on the status of your registration.

For more information visit:

License Plate Voucher Redemption

What is a Voucher and does it apply to me?

Upon the Florida Legislature's approval of any new specialty license plate, the FLHSMV

requires the sale of 3,000 preorders, also known as "pre-sale vouchers" before the new plate can be produced and distributed. Once 3,000 vouchers are sold, license plates are printed and delivered to Florida Tax Collector Offices for everyone to purchase and actually put a plate on their car.

Do customers need proof of voucher purchase?

No. Vouchers are electronically attached to driver records in Florida's registration system. Customers can redeem their voucher at any tax collector's office without the original receipt.

Are pre-sale vouchers refundable or transferable?

No. Once the pre-sale requirement was met, refunds and transfers are not available. Vouchers and gift certificates are non-transferable.

Vehicle Eligibility

Eligible vehicles for a FSWI specialty plate?

• Automobiles

• Leased cars

• Golf Carts

• Small/heavy trucks (under 7,999 GVW)

• Trailers, utility trailers

• RVs & motorhomes

Non-Eligible vehicles for a FSWI specialty plate?

• Vehicles registered under the International Registration Plan

• Commercial trucks requiring two license plates

• Truck tractors

Dealer & Fleet Orders

Dealer Plates

Process for obtaining dealer plates (

see pdf here):

• Dealers must cover all standard and specialty plate fees.

• License plates are manufactured after paperwork is submitted to FLHSMV and the county.

• The DLR designation will be stacked to the right of the plate image (

see pdf here)

Fleet Companies

Fleet companies can order fleet specialty plates instead of standard fleet plates. Process is the same as dealer plates.

Motorcycles & Business Orders

Can vouchers be purchased for motorcycles?

No. Not at this time.

Can businesses buy multiple plates for their fleet?

Yes. Businesses can purchase a voucher for each vehicle or trailer. Tax deduction depends on tax status, businesses may be able to deduct all or part of the fees.